What is an Invoice Pro Forma?

An invoice pro forma is a type of commercial document that serves as a preliminary invoice or quote. It’s often sent to potential clients before a formal contract is signed or services are rendered. Think of it as a draft invoice that outlines the expected terms and conditions of a transaction.

Why Use an Invoice Pro Forma?

1. Setting Expectations: An invoice pro forma helps clarify expectations between you and your client. It outlines the scope of work, pricing, payment terms, and delivery dates.

2. Negotiation Tool: It can be used as a negotiation tool, allowing both parties to discuss and adjust the terms before finalizing the agreement.

3. Legal Protection: While not legally binding, it can provide some level of protection in case of disputes.

4. Marketing Tool: It can be used as a marketing tool to showcase your services and attract potential clients.

Creating an Invoice Pro Forma

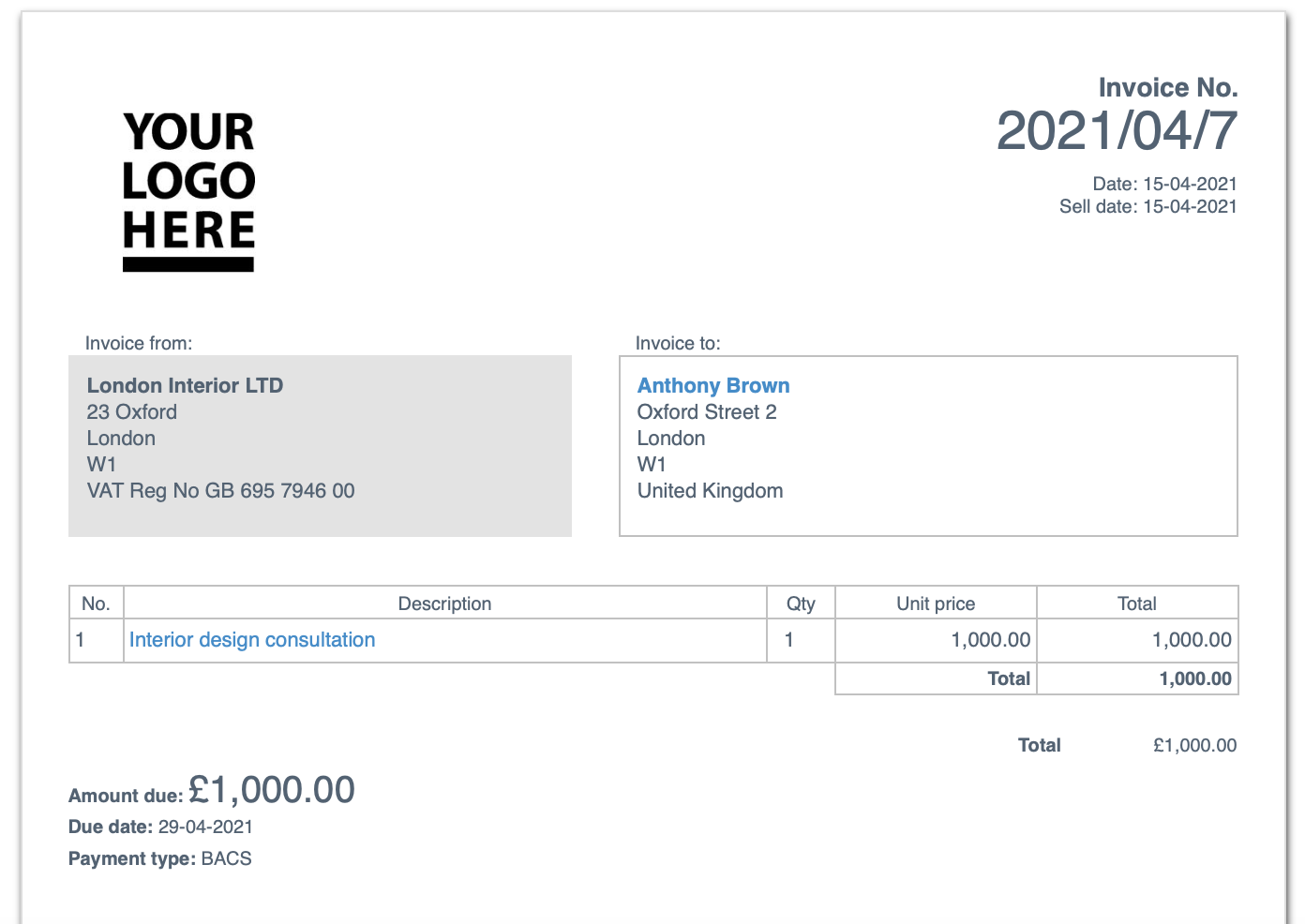

Image Source: siteor.com

When creating an invoice pro forma, include the following essential information:

Your Company Information: Your company name, address, contact details, and tax identification number.

Conclusion

An invoice pro forma is a valuable tool for businesses of all sizes. By using it effectively, you can improve communication with your clients, streamline your sales process, and protect your business interests.

FAQs

1. Is an invoice pro forma legally binding? No, an invoice pro forma is not legally binding. It serves as a preliminary document and can be modified before finalizing the agreement.

2. Can I send an invoice pro forma after services have been rendered? Yes, you can send an invoice pro forma after services have been rendered, but it’s generally best to send it before or at the beginning of the project.

3. What is the difference between an invoice pro forma and a commercial invoice? A commercial invoice is a legal document used for customs clearance and international trade. It includes more detailed information about the goods being shipped, such as their value, weight, and country of origin.

4. Can I use an invoice pro forma template? Yes, using an invoice pro forma template can save you time and ensure consistency in your documents. There are many free and paid templates available online.

5. Should I include my company’s logo on an invoice pro forma? Yes, including your company’s logo can help make your invoice pro forma more professional and memorable.

Invoice Pro Forma