What is a Sale Invoice?

A sale invoice is a document issued by a seller to a buyer detailing the goods or services provided, their quantity, and the total cost. It’s essentially a receipt that serves as proof of purchase.

Why are Sale Invoices Important?

1. Legal Record: Sale invoices serve as legal proof of a transaction. If there’s a dispute, the invoice can be used as evidence.

2. Accounting Purposes: For both the seller and buyer, invoices are crucial for maintaining accurate financial records.

3. Tax Documentation: Invoices are often required for tax purposes, as they can help determine taxable income and deductions.

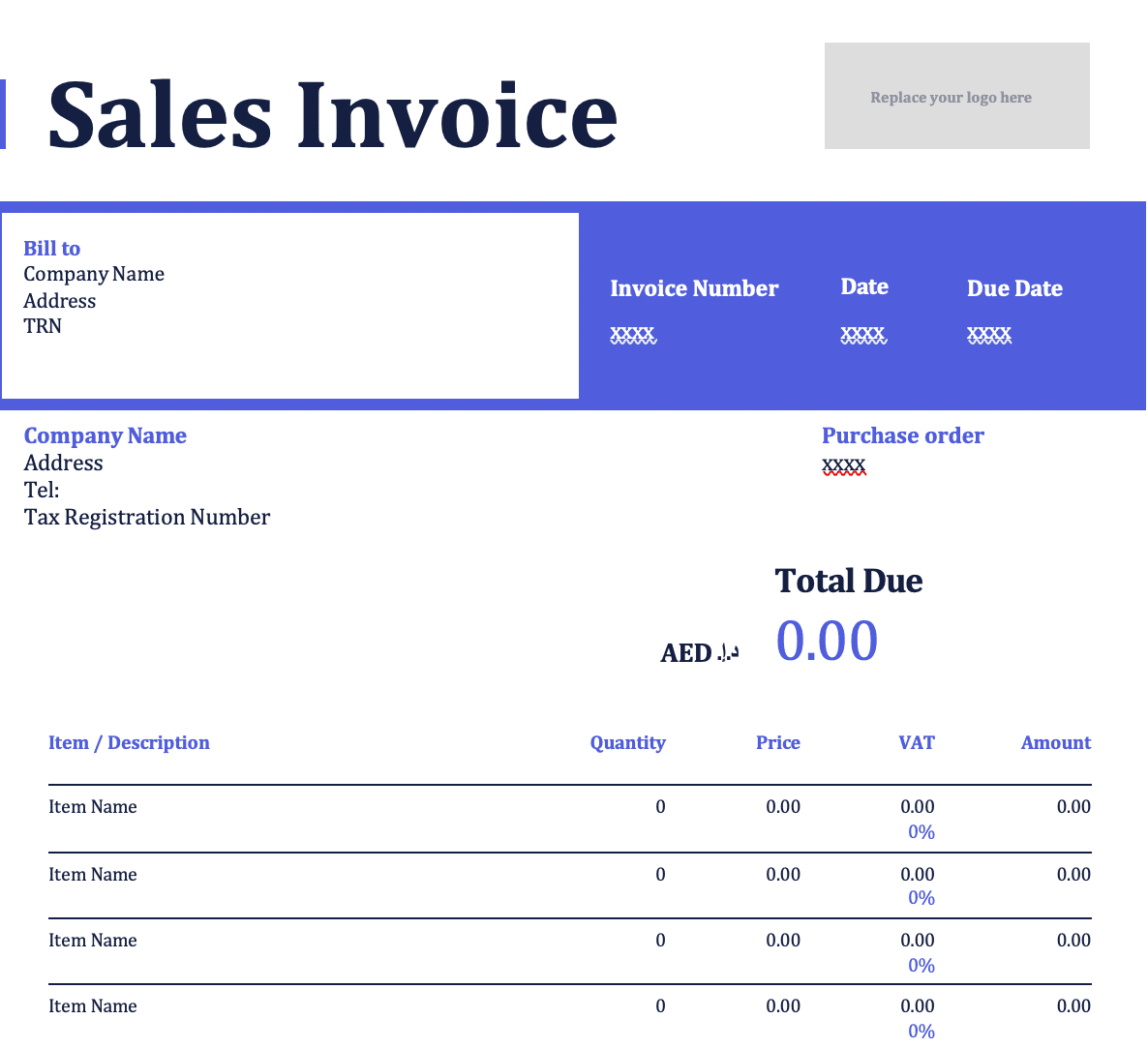

Key Components of a Sale Invoice

Image Source: wafeq.com

Seller’s Information: Name, address, and contact details.

Creating a Sale Invoice

You can create sale invoices using various methods:

Manual Creation: Use pen and paper or a word processor to create a customized invoice.

Best Practices for Sale Invoices

Clarity and Accuracy: Ensure that the invoice is clear, easy to read, and contains accurate information.

Conclusion

Sale invoices are essential documents for businesses of all sizes. By understanding their importance and following best practices, you can ensure accurate financial records and smooth transactions.

FAQs

1. What is the difference between a sale invoice and a receipt? While both documents confirm a purchase, a sale invoice provides more detailed information about the transaction, including itemized lists and payment terms.

2. Can I use a sale invoice as proof of payment? Yes, a sale invoice can serve as proof of payment if it’s accompanied by a payment confirmation (e.g., bank statement, credit card receipt).

3. Is it necessary to include a due date on a sale invoice? While not always mandatory, including a due date helps set expectations for payment and can improve cash flow management.

4. Can I issue a corrected invoice if I made a mistake on the original? Yes, you can issue a corrected invoice, clearly indicating that it replaces the previous version.

5. Are there any specific legal requirements for sale invoices in my country? Local laws may have specific regulations regarding the content and format of sale invoices. It’s essential to consult with legal or tax professionals to ensure compliance.

Sale Invoices